Midstream’s Holiday Road

While you were enjoying the Labor Day weekend with an end-of-summer cookout or a dip in the lake, numerous midstream operators were asking, “Holiday? What holiday?” The blitz of M&A, infrastructure expansion, and new gas-fueled opportunities has made midstream darn sexy these days with no time to waste on barbeque or pontoons. Oh no, there’s stuff to get done on their own holiday road.

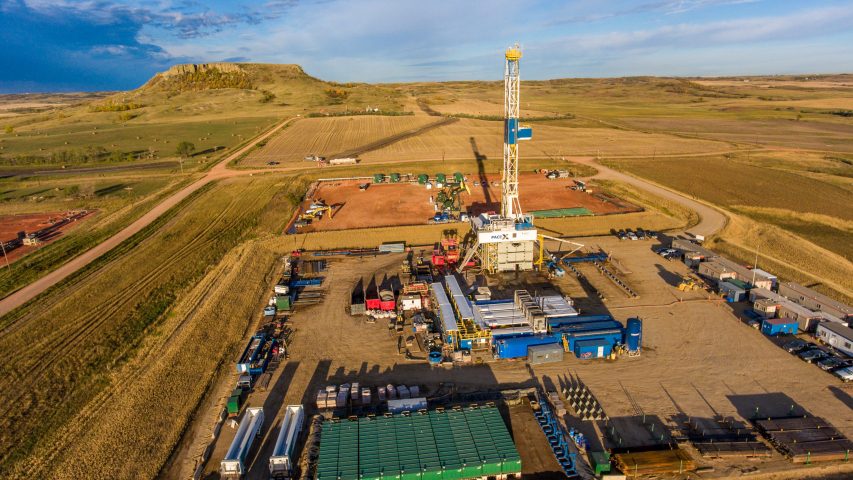

Reese Energy Consulting is following the latest from the busy midstream sphere starting with Chevron and its inheritance of Hess Midstream as part of the former’s $53 billion acquisition of Hess Corporation in 2023. With gathering, processing, storage, terminaling, and export assets in the Bakken and Williston, analysts are divided on the fate of Hess Midstream and whether Chevron will keep it or leap it.

Antero Resources, which operates exclusively in the Marcellus and Utica, is mulling the sale of an Ohio Utica position that includes 82,000 net acres and Antero Midstream assets in a package deal that could fetch as much as $1 billion. Timing, anyone?

On the buyer side, Plains All American has swooped up a 55% interest stake held by Diamondback Energy and Kinetik Holdings in the EPIC crude oil pipeline system for $1.57 billion. The 800-mile EPIC flows more than 600 MBPD from the Permian to Gulf Coast markets.

In growth and Texas bonus news, Brazos Midstream will build a new $185 million cryogenic gas plant dubbed Sundance II in Martin County and supported by the state’s Jobs, Energy, Technology, and Innovation (JETI) program.