More Asset Swaps in the Eagle Ford

The deals keep on keeping on in the Eagle Ford, which has seen a dramatic uptick in mergers, acquisitions, and renewed investment interest over the last year. While production in the Permian continues to slow, crude oil production in the Eagle Ford this year is expected to ramp up 4% with an average monthly increase of ~17 MBPD that began in the latter part of 2022. U.S.-based Marathon and Devon recently scored billion-dollar babies here, but there’s also some new Eagle Ford swapping on the international front.

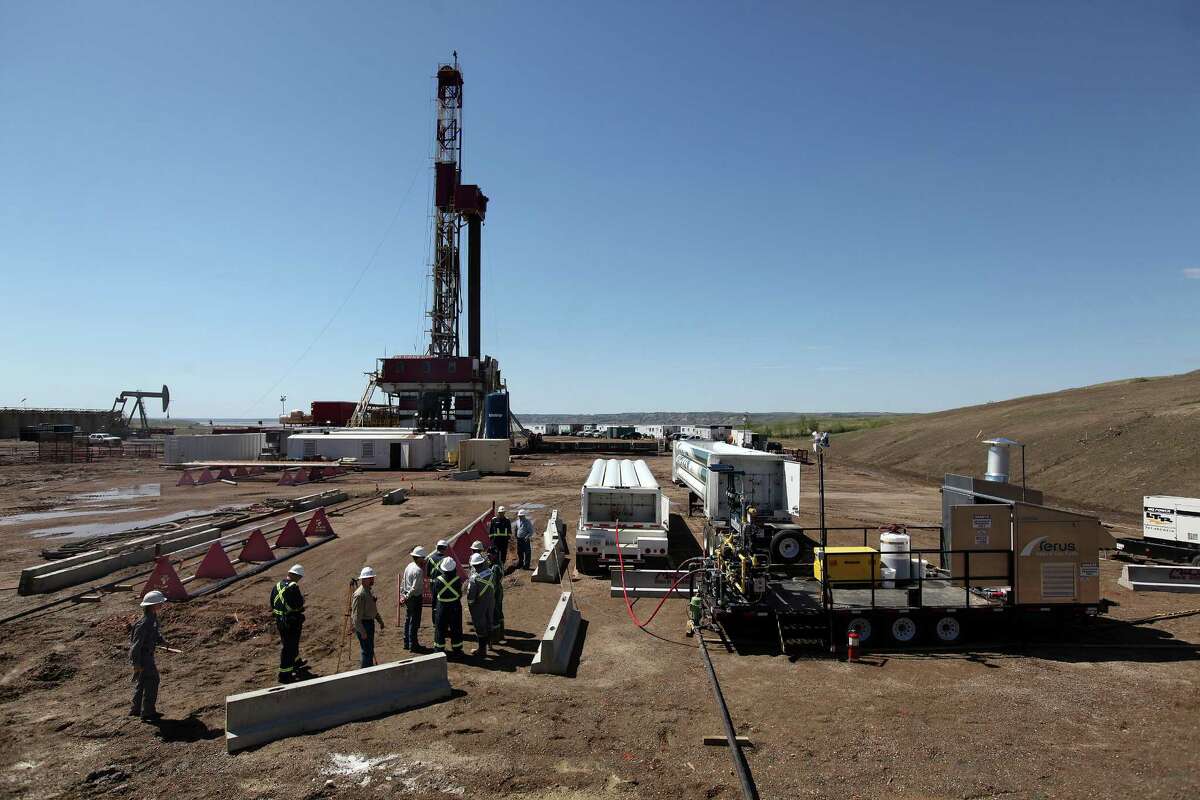

Reese Energy Consulting today is following the latest news from Spain’s global energy behemoth Repsol, which has operated in the Eagle Ford since 2019 after acquiring 70,000 net acres with 34 MBOED of production for $323 million from former partner, Equinor. Repsol now has added 126,364 net acres with average production of 48.9 MBOED to its footprint from Japan’s Inpex–the country’s largest E&P. The price was not disclosed but the deal effectively shutters Japan’s U.S. shale operations. Aside from its Eagle Ford assets in the U.S., Repsol also operates in the Texas Gulf and the Marcellus and has recently approved a $5.6 billion development project on Alaska’s North Slope with first production expected in 2026.