The $64 Billion Question

If you received a rumor alert last Friday that ExxonMobil was on the romance prowl (again) with Pioneer Natural Resources, you and a few million others are no doubt wondering if, when, and how a Permian shakeup of this magnitude will, uh, shake out. There’s been no lack of opining since that first news nugget by Reuters. As a matter of fact, speculation of a possible pairing valued as high as $64 billion—$8.3 billion more than Exxon made in profits last year—is whipping up a media tizzy.

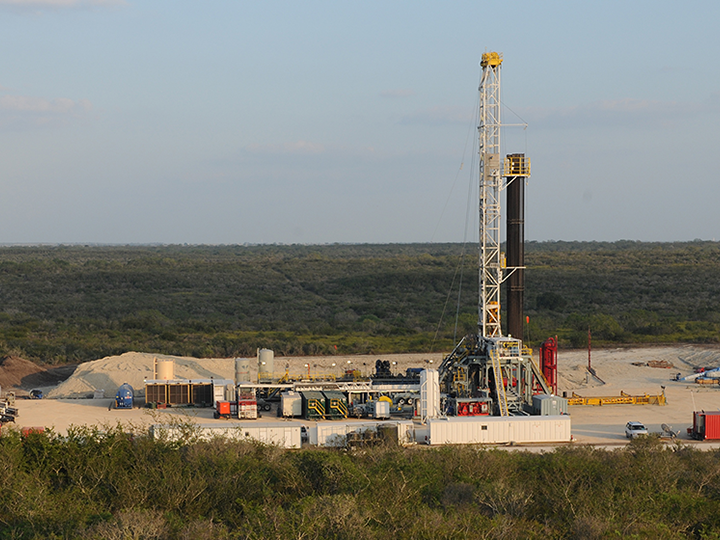

Reese Energy Consulting today is studying would what be a Titanic-sized deal that also rips the wind from the sails of the term “energy transition.” Exxon may have some tentacles in alternative fuels, but demand for fossil fuels will still increase through 2050 and liquids are Exxon’s bread and butter. Pioneer is a fossil fuels poster child in the Permian with 1+ million acres and decades of drilling inventory in the Midland. Exxon, which makes no bones about its appetite for more Permian coverage with long inventory life, operates 275,000 acres in the Midland. Pioneer this year expects crude production of 364 MBPD at a cost of $13.25 per BOE, placing up to 530 wells in production, and $9 billion in cash flow that will be used to fund its 2023 capital program. The company also added a 152% increase of proved reserves totaling 365 MMBOE.