A Roar into ’24

If there’s one grand takeaway from 2023, it’s this—don’t bet against the U.S. oil and gas industry. The nation’s production last year of fossil fuels and LNG exports launched us to the world’s top spot. Crude oil volumes made world history. And we produced them safer, more efficiently, and more responsibly than any other country on the planet. It’s a pretty big deal, and one of many big deals kickstarting 2024 only four days in.

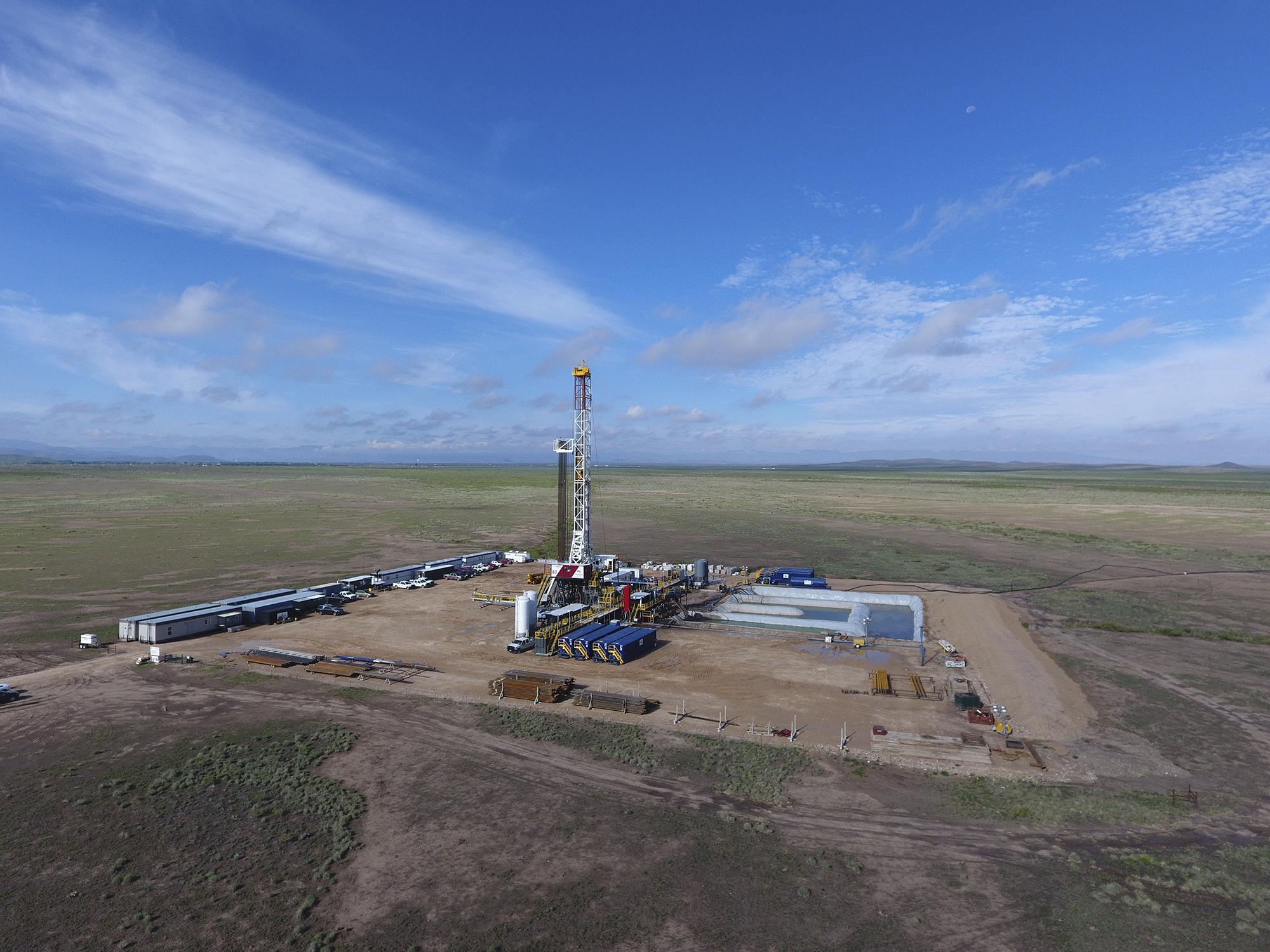

Reese Energy Consulting today is following the latest M&A news from Houston-based APA Corporation, which operates subsidiary Apache Corporation. A quick primer: Apache is what you’d call an OG in the industry, kickstarting its own E&P aspirations in 1954. The company controls domestic and international assets that extend from Texas and the Gulf Coast to the North Sea and Egypt. APA heads up the company’s partnership with TotalEnergies in the hotter-than-Hades play in South America’s Suriname. But Permian production of 225.6 MBOED is APA’s bread and butter, where Apache holds 3.5 million acres and 6,000 wells in the Northwest Shelf and the Delaware.

APA has now announced it will acquire Houston-based Callon Petroleum—another OG since 1950—in a $4.5 billion all-stock purchase that includes 145,000 acres and 101.7 MBOED in the Delaware. It’s a big deal for APA. Pro-forma, the new Permian addition tips the company’s overall production scale stateside, contributes to an expected total 500 MBOED, and increases APA’s value at $21 billion.