Bucking the Trend

The upstream M&A trend continues this year with producers focused on consolidating their existing portfolio positions in core operating basins. Deals made in 1Q totaled a sleepy $8 billion but jerked to life in 2Q with 20 acquisitions for a combined $24 billion. Chevron capped the largest with its $7.6 billion purchase of PDC, making a king-size exception to the surge in Permian grabs by ballooning its DJ assets. For producers, growth strategies by way of geological diversity seem to have vanished from the whiteboard these days. But what of those who recently made that diversity priority one?

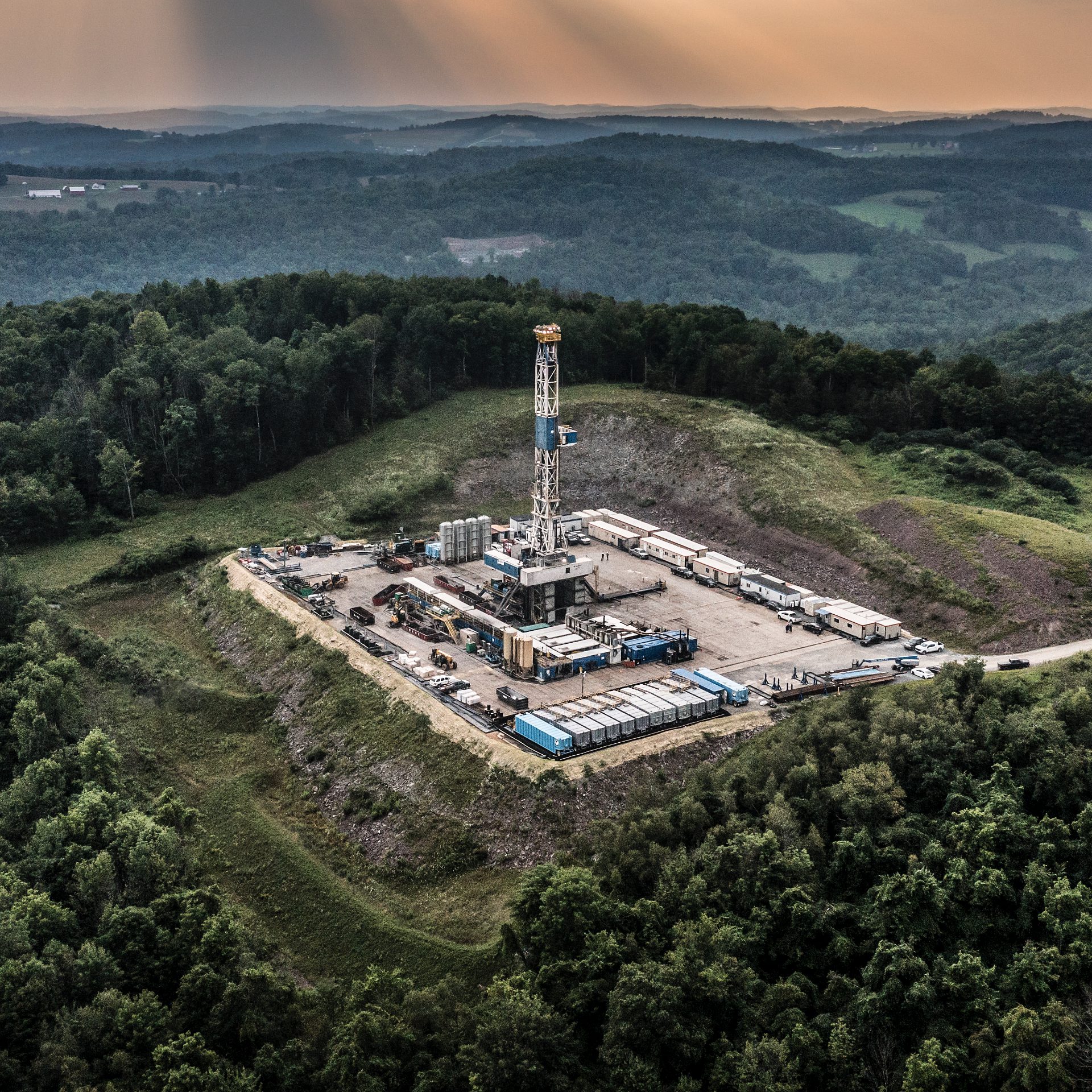

Reese Energy Consulting today turns back the calendar to 2021, when a merger of equals between two producers driving in different lanes not only bucked the trend but became the largest deal of the year. In a gob-smacking surprise, Houston-based Cabot Oil & Gas and Denver-based Cimarex announced they would combine in a merger valued at $17 billion. Cabot, a pure-play natural gas operator in the Marcellus producing 2.35 BCFD, and Cimarex, a mostly crude oil player in the Delaware and Anadarko producing 219 MBPD, became Coterra Energy. The newly minted company, according to the then-Cimarex CEO, took both entities “off the commodity rollercoaster.”

Today, Coterra operates 307,000 net acres in the Delaware, 183,000 net acres in the Marcellus, and 182,000 net acres in the Anadarko. The company recently upped its gas production guidance by 2% and crude oil by 3% and returned 184% of 2Q free cash flow to shareholders, proving that sometimes when others zig it’s better to zag.