Oxy Considers a Dice Throw

If you’re feeling especially unlucky today, it’s best to avoid any one of Earth’s five oceans lest a chunk of a dead satellite now in freefall makes touchdown on your noggin. But if you’re one of the nation’s largest midstreamers eyeing a sizeable acquisition that ticks all the boxes on growth strategy, you just might be in luck.

Reese Energy Consulting today is following the whopper of a surprise teaser made possible by paid tattletales (anonymous sources), suggesting Houston-based Oxy is considering an exit stage right on its midstream operations known as Western Midstream, which has a valuation of $18+ billion. This follows Oxy’s $12 billion gulp of CrownRock in December—and mama needs a new pair of shoes to pay for it. A peek back at 2019: Oxy inherited WES as part of its $54 billion acquisition of Anadarko Petroleum of which the crown jewels of that deal set fat and all sparkly in Permian production and acreage. The rest is happy-hour history. But make no mistake, WES has jewels of its own that will no doubt tempt the cream of the midstream crop to fire up a new spreadsheet.

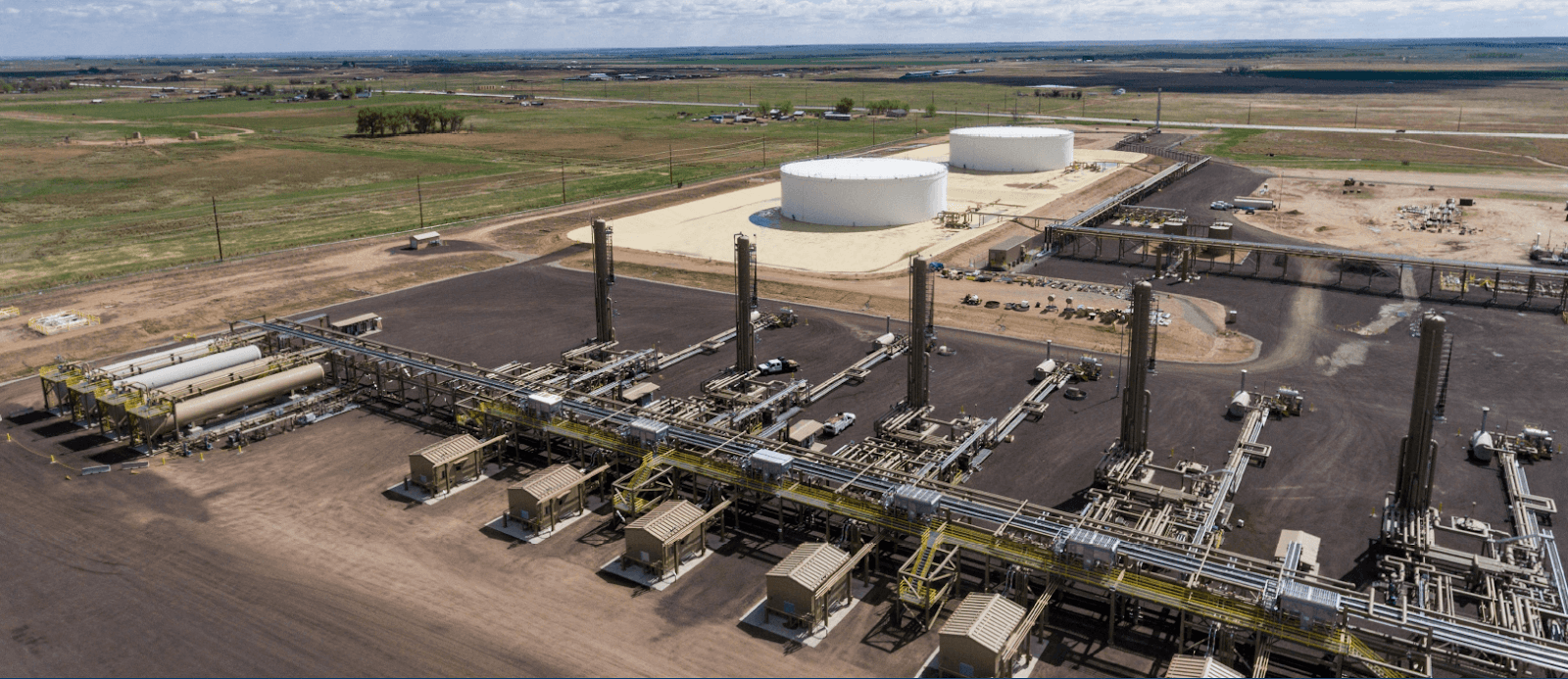

Houston-based Western Midstream, which operates 16,000 miles of pipelines, holds court primarily in the Permian and DJ, with sister assets in Utah, Wyo., South Texas, and the Marcellus. Its sweetest spot lies in the heart of the Delaware, with 3,300 miles of pipe and 31 gas processing and treating plants, followed by gathering pipe and five processing plants in the DJ. To drum up the drama (and $$$) should an auction come to fruition, potential suitors have already been identified for Oxy’s midstream package, which the company hopes to fetch $5+ billion. And what a gem of a prize for the lucky bidder who’s steered clear of the ocean.