Better Together

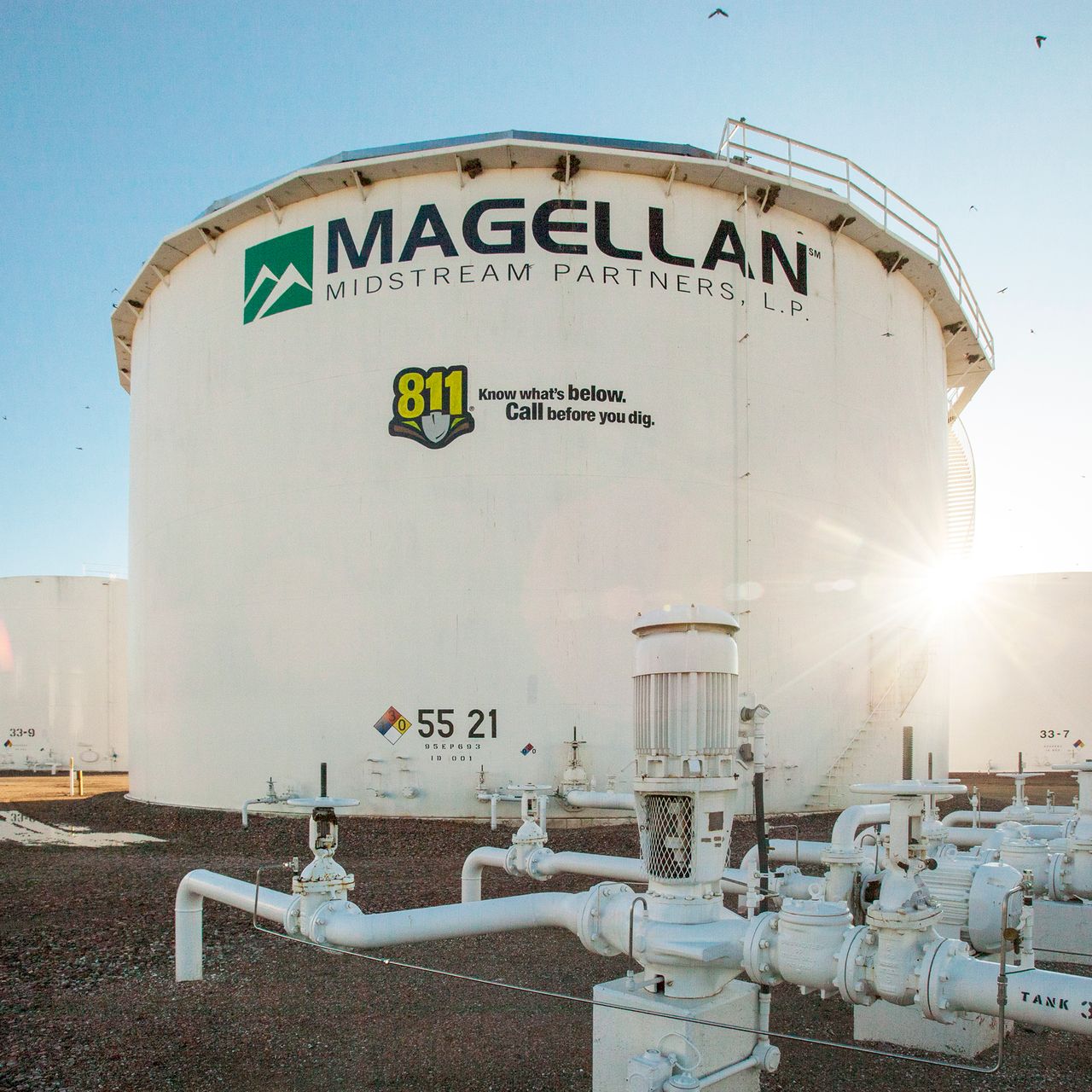

It was a year to the month last May that Aaron Milford took the reins as CEO of Tulsa-based Magellan Midstream and its 9,800 miles of refined products pipelines, 2,200 miles of crude oil pipe, 56 terminals, and 39 MMbls of storage. The anniversary of that date was sealed with a whopper of an announcement no one expected—that natural gas and NGLs midstream operator (and blocks-away neighbor) ONEOK would acquire Magellan for $18.8 billion.

Reese Energy Consulting today is following the latest on the proposed merger of the two, now juggling the last of formalities that will make ONEOK an energy infrastructure giant 50,000 pipeline-miles long. It wasn’t so much the price tag that surprised, as it was ONEOK’s decision to diversify its business into new hydrocarbon territory.

For Magellan, the path to win over shareholders hasn’t come without a few sharp-edged rocks in the form of some investors naysaying the combo ahead of a vote to approve the deal September 21. Meantime, Milford has been front and center to discuss the rationale behind the merger, Magellan’s future as part of ONEOK, and the shareholder value he sees going forward. Together, he says, the two companies create a more powerful growth engine with greater opportunities to expand. In particular, Milford points out the ability to transport gas, NGLs, crude, and refined products on the same pipeline systems, annual cost-savings between $200 million and $400 million, and the increasing demand for natural gas in the utility and industrial sectors. Fingers crossed and if the creek don’t rise, we hope to see a big vote of confidence in September.