Exxon’s $60 Billion Permian Love Story

The biggest oil and gas deal in years looks to be upon us and this time reports have replaced rumors, negotiations have advanced, and a $60 billion price tag lays in wait. Reese Energy Consulting today is following news that the on-again, off-again romance between ExxonMobil and Irving, Texas-based Pioneer Natural Resources has heated up faster than two love-sick adolescents on a first date.

Whispers of a potential coupling began five years ago following Exxon’s $5.6 billion acquisition in 2017 of companies owned by the famed Bass family of Fort Worth. While a deal with Pioneer didn’t materialize then, Exxon went on to steadily build its Permian foothold but never took its eye off the big prize. The rumor mill fired up again in April. A deal could be imminent, headlines declared, then died away as quickly as they came. Until now.

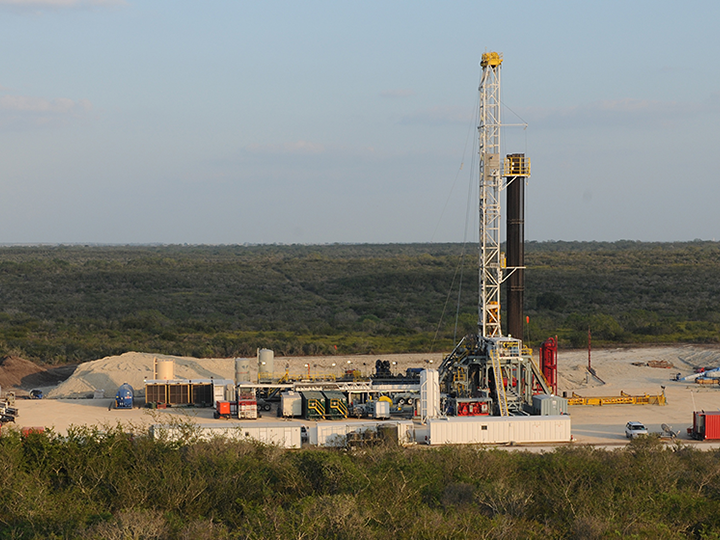

Exxon, which operates in both the Midland and Delaware, reported 2Q production of 620 MBOED with plans to reach 1 MMBOED by 2027. Pioneer, which operates exclusively in the Midland, reported August production of 711 MBOED (359 MBOD). The rationale behind a merger this size seems a no-brainer for the nation’s largest oil producer absorbing the third-largest Permian player. In the most simplistic terms, it boils down to scooping up more of everything Exxon needs—producing wells, drilling locations, acreage, and most importantly, reserves. Still, losing an independent of Pioneer’s stature to a supermajor is on the bittersweet side for those of us who’ve followed this company since its earliest days. Another chapter for the history books we hope is richly preserved.